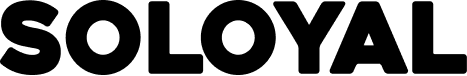

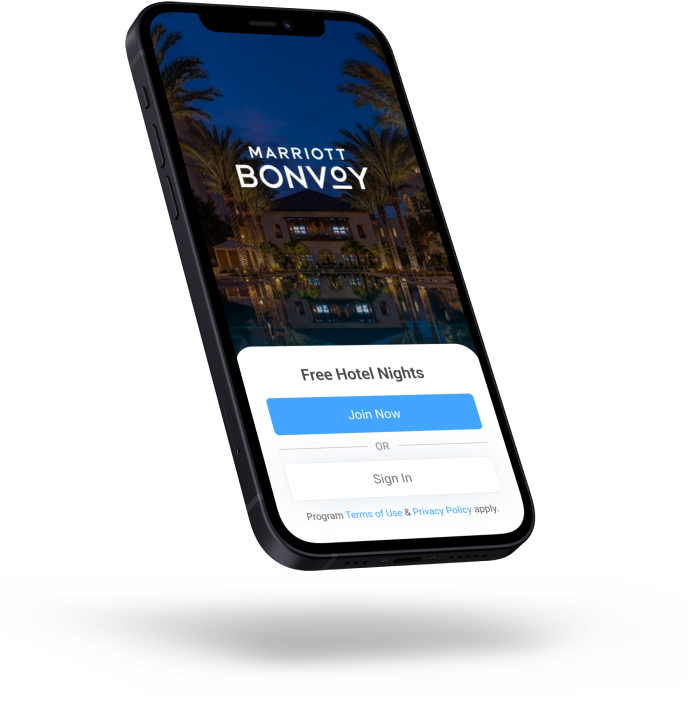

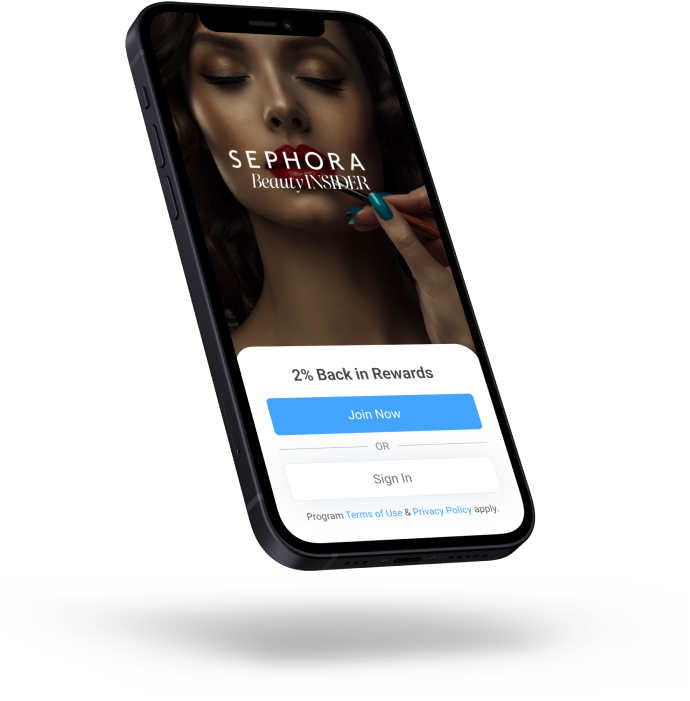

Join and track loyalty programs

Never miss points or rewards

A Life Saver!

5/5

Join and track loyalty programs

Never miss points or rewards

A Life Saver!

5/5

Track points, nights, miles & rewards.

Know your status across every brand's loyalty program.

Highly Rated!

5/5

Loyalty on time,

every time.

Expiring points and new reward updates.

Works Great!

5/5

Ready to Get Started?

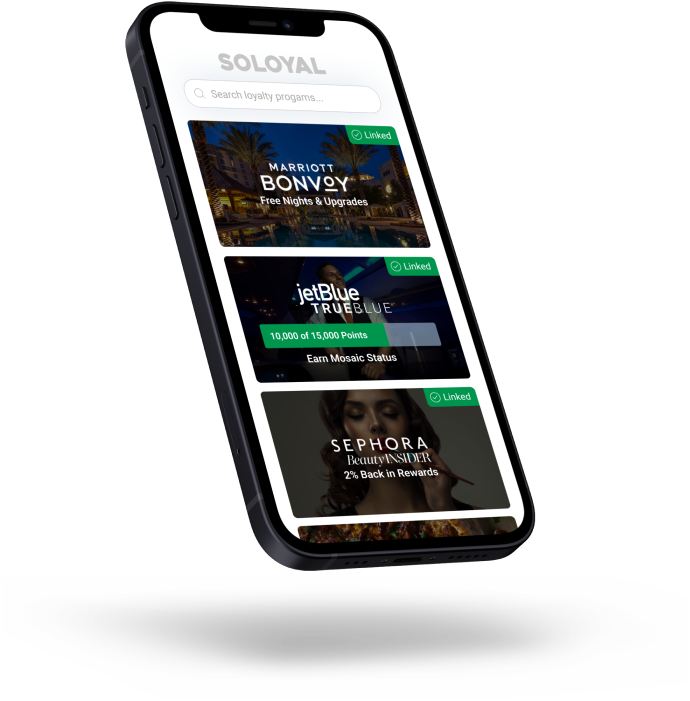

Join or link hundreds of loyalty programs with a single tap.

Browse loyalty programs by country